Recently, there has been widespread confusion regarding an alleged new IRS direct deposit relief payment in 2025. Claims of a surprise payment of $1,390 hitting bank accounts have been circulating on social media and various websites, reminiscent of the COVID-19 Economic Impact Payments issued in previous years. This article aims to clarify the current situation, explain what IRS payments are available, and help taxpayers distinguish facts from myths about relief payments this year.

What Is the IRS Direct Deposit Relief Payment?

The IRS distributed Economic Impact Payments, commonly known as stimulus checks, during the height of the COVID-19 pandemic in 2020 and 2021 to provide financial relief to Americans affected by the economic downturn. These payments were part of several government stimulus packages aimed at helping families manage during uncertain times.

However, as of 2025, there are no new direct deposit relief payments or stimulus checks authorized by the IRS. The last rounds of these payments concluded several years ago following improvements in the economy. Therefore, any news or posts suggesting that a new payment of $1,390 or any other amount is being automatically sent out this month are inaccurate.

Current IRS Payments in 2025

Although no new relief payments exist, the IRS continues to process certain tax credits and refunds that may result in payments to taxpayers:

- The Recovery Rebate Credit remains available for eligible taxpayers who did not claim stimulus payments in prior tax years. This means if you filed your 2021 tax return and qualified but missed claiming past Economic Impact Payments, you might still receive a catch-up payment.

- Regular tax refunds based on filed returns continue as usual.

- Other credits like the Child Tax Credit or Earned Income Tax Credit are administered according to current tax laws.

These payments are not distributed under any new “relief payment” program and will not be labeled as stimulus checks.

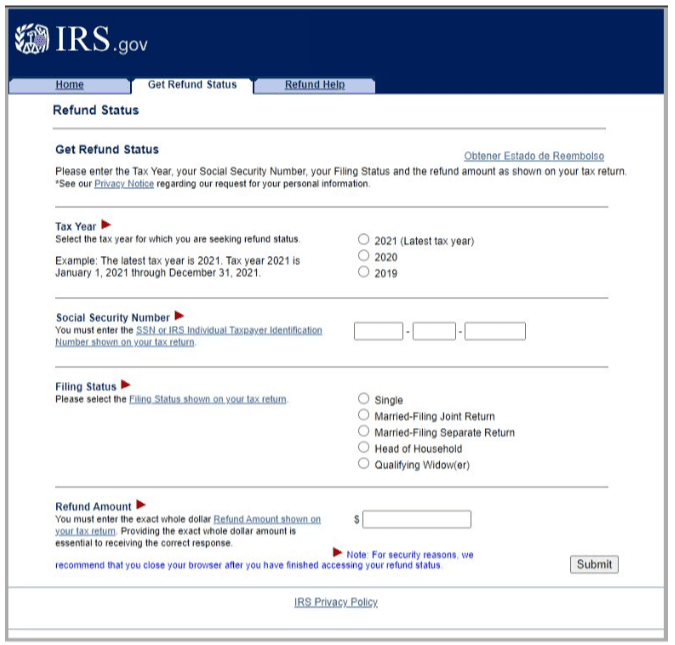

How to Check Your IRS Payment Status

For those wondering whether they qualify for any IRS payments or refunds, the best and safest approach is to check directly through official IRS channels. You can create or access your IRS online account at IRS.gov, where you can securely view your refund status and payment history. The IRS also offers the “Where’s My Refund?” tool that provides quick updates on tax refunds.

Be cautious of unofficial websites or social media links that offer to check your payment status—these are often phishing scams aiming to steal personal information.

If interested, a more detailed guide on how to safely check your IRS refund status online can provide step-by-step instructions to avoid scams and ensure accuracy.

Debunking Common Myths

Several misconceptions about IRS direct deposit relief payments continue to spread:

- Myth: The IRS is sending new $1,390 payments automatically in October 2025.

Truth: There are no such payments authorized or planned this year. - Myth: You must enter private data on third-party websites to receive your payment.

Truth: The IRS only collects information through official channels like IRS.gov and will never ask for sensitive data through email or social media. - Myth: Unclaimed stimulus payments from past years will be automatically deposited later.

Truth: To receive any outstanding Recovery Rebate Credit, taxpayers need to file or amend their tax returns.

To learn more about scam recognition and tips to avoid IRS scam emails and phishing, readers can refer to specialized resources explaining how to spot fraud attempts.

Recommendations for Taxpayers

To stay safe and informed:

- Always rely on official IRS sources such as the IRS Economic Impact Payments page for trusted updates.

- File your tax returns promptly to ensure you claim any refundable credits you may be entitled to.

- Be vigilant against scams and suspicious communications claiming to represent the IRS.

- Use IRS online tools like the Where’s My Refund? tool regularly to track your refund or payments.

For deeper understanding, it’s helpful to explore how the Recovery Rebate Credit Explained and the full range of IRS tax credits currently available.

Recommended Article

For those interested in expanding their knowledge on related topics, consider reading the coming soon articles below:

- How to Safely Check IRS Refund Status Online

- Understanding the Recovery Rebate Credit Explained

- Tips to Avoid IRS Scam Emails and Phishing

- Complete Guide to IRS Tax Credits and Rebates in 2025

Conclusion

In summary, the IRS is not issuing any new direct deposit relief payments or stimulus checks in 2025. While some refundable credits and tax refunds continue to be processed, claims about new automatic payments should be treated with caution and verified through official IRS channels only.

Staying informed through trusted sources and understanding IRS processes helps protect taxpayers from misinformation and scams. For more detailed tax credit information or refund tracking, consulting additional articles related to IRS payments and scam avoidance can be beneficial.