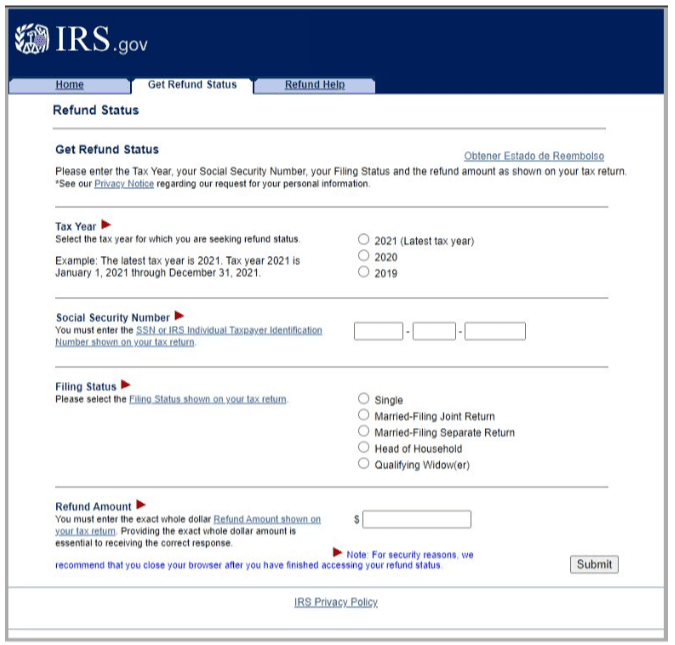

Why Every Smart Investor Uses TradingView If you’re serious about trading or investing, TradingView is a name you’ve probably heard again and again.This powerful platform has revolutionized how traders analyze markets, build strategies, and share insights online. In this TradingView Review 2025, we’ll explore why it remains the best charting and analysis platform, trusted by millions of investors worldwide — from beginners to professionals. 👉 Ready to experience it?Try it here: TradingView What Is TradingView? TradingView is an advanced web-based platform that provides real-time market data, charting tools, and community insights.It’s designed for stocks, forex, crypto, ETFs, and commodities, making it one of the most versatile investment tools ever built. Unlike traditional trading software, TradingView works seamlessly in your browser, with no downloads required — offering professional-grade analysis to anyone, anywhere. Top Features of TradingView 1. World-Class Charting Tools TradingView’s charts are among the best in the world — clean, fast, and fully customizable.You can add dozens of technical indicators, draw trendlines, use Fibonacci retracements, and apply over 100 different chart types. 2. Social Community of Traders One of the platform’s greatest strengths is its interactive community.You can follow expert traders, share strategies, and learn from others — similar to a “social network” for investors. 3. Powerful Alerts and Automation TradingView lets you set price alerts, news alerts, and even scripted conditions using Pine Script, its proprietary programming language for custom strategies. 4. Multi-Device Compatibility Access your account anywhere — on desktop, mobile, or tablet.Your watchlists and charts stay perfectly synchronized. 5. Integration with Brokers TradingView connects directly to top brokers, allowing users to execute trades from the charts in real time. Benefits of Using TradingView Whether you’re trading forex, stocks, or crypto, TradingView helps you make smarter, faster, and more confident decisions. 👉 Try TradingView TradingView vs Competitors Feature TradingView MetaTrader Finviz TrendSpider Cloud-based access ✅ ❌ ✅ ✅ Built-in social network ✅ ❌ ❌ ❌ Pine Script automation ✅ ⚠️ Limited ❌ ✅ Broker integration ✅ ✅ ❌ ✅ Free version available ✅ ✅ ✅ ⚠️ Limited As the comparison shows, TradingView delivers unmatched flexibility, social features, and data visualization capabilities — making it a must-have tool for any modern trader. Why TradingView Is the Best Choice in 2025 With the rise of AI-driven investing, retail participation, and real-time analytics, TradingView continues to lead the industry with constant innovation and community-driven insights. It’s not just a charting platform — it’s an ecosystem for smarter investing. If you’re still relying on outdated tools, you’re missing out on faster execution, deeper insights, and a community that helps you grow. 👉 Start using TradingView now and experience the difference. Final Thoughts TradingView is the ultimate all-in-one platform for traders and investors who value precision, community, and innovation.Its combination of data accuracy, advanced tools, and ease of use makes it essential for anyone who wants to level up their financial game in 2025. Don’t just watch the market — understand it like a pro with TradingView. 👉 Start your journey here: TradingView