Are Marginal Costs Fixed or Variable Costs?

Fact checked by Michael Rosenston

Marginal costs of production are defined as the overall change in costs when a company or manufacturer increases the amount produced by one unit. Marginal costs can help firms determine the level at which it achieves economies of scale.

Key Takeaways

- Marginal costs are the costs associated with producing an additional unit of output.

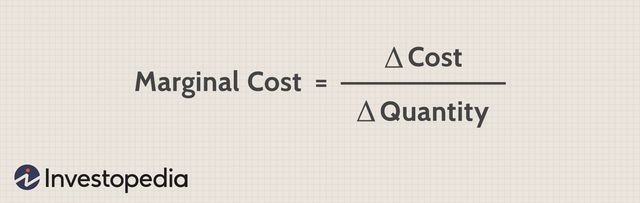

- It is calculated as the change in total production costs divided by the change in the number of units produced.

- Marginal costs exist when the total cost of production includes variable costs.

- There are different types of marginal costs, including marginal social costs, marginal private costs, and marginal external costs.

Marginal cost is calculated as follows:

Image by Sabrina Jiang © Investopedia 2021

Understanding Marginal Costs

Marginal costs are a function of the total cost of production, which includes fixed and variable costs. Fixed costs of production are constant, occur regularly, and do not change in the short-term with changes in production.

Examples of fixed costs are rent and insurance payments, property taxes, and employee salaries. By contrast, a variable cost is one that changes based on production output and costs. For example, a country club with a swimming pool may spend more money on chlorine in the summer months.

There is a marginal cost when there are changes in the total cost of production. Since fixed costs are constant, they do not contribute to a change in total production costs. Therefore, marginal costs exist when variable costs exist.

Types of Marginal Costs

Marginal costs are also broken down into various forms. Social costs are the overall costs to society. Marginal social costs are the costs to society from the production of an additional unit of output. In many instances, this may be difficult to quantify, though the negative externalities are evident.

An example of this is the impact of extracting coal on the environment. We often see and smell pollution from production, but calculating the associated societal costs is a complex process as it is difficult to measure and may take years to realize. Marginal social costs can still be factored into production, for example, when lawmakers define the rules governing how a company produces its goods. Overall, marginal costs are in large part a function of a consumer’s choice.

A marginal private cost is the cost incurred by a company to produce another unit of a good. A marginal external cost is the cost imposed by producing another good on third parties who are not the buyer or the seller. Producing a new car creates a private marginal cost to the manufacturer in the form of the cost of all additional resources that went into making the car. Third-parties can external incur costs as a result of the car being produced and someone buying and driving it. For example, both the production and use of the car will release harmful pollutants into the atmosphere.

Example of Marginal Costs

Take the example of a buyer purchasing dresses. The buyer initially purchases 10 dresses a month. However, if the buyer purchases 11 dresses, the overall change to the supplier in costs to produce an extra dress constitutes marginal costs. Another way to consider this is that marginal costs vary based on the level of output. Marginal costs are thus incurred when 11 dresses are produced instead of 10. There is also believed to be a marginal benefit to the buyer for the value of the dress.