Introduction

Looking for the best investment guide for 2025? This is your ultimate resource. With AI reshaping industries, inflation stabilizing, and digital assets maturing, investors are facing a landscape full of opportunity—and risk. This guide helps you make smart investment decisions across the USA, UK, Canada, Australia, Europe, and Brazil.

1. Why 2025 Is a Pivotal Year for Investors

- AI Integration: From banking to agriculture, AI is driving productivity and innovation.

- Green Transition: ESG and renewable energy investments are gaining traction.

- Digital Finance: Fintechs, blockchain, and CBDCs are redefining money.

- Global Realignment: Post-pandemic recovery and geopolitical shifts are creating new market dynamics.

Read Deloitte’s 2025 Investment Outlook

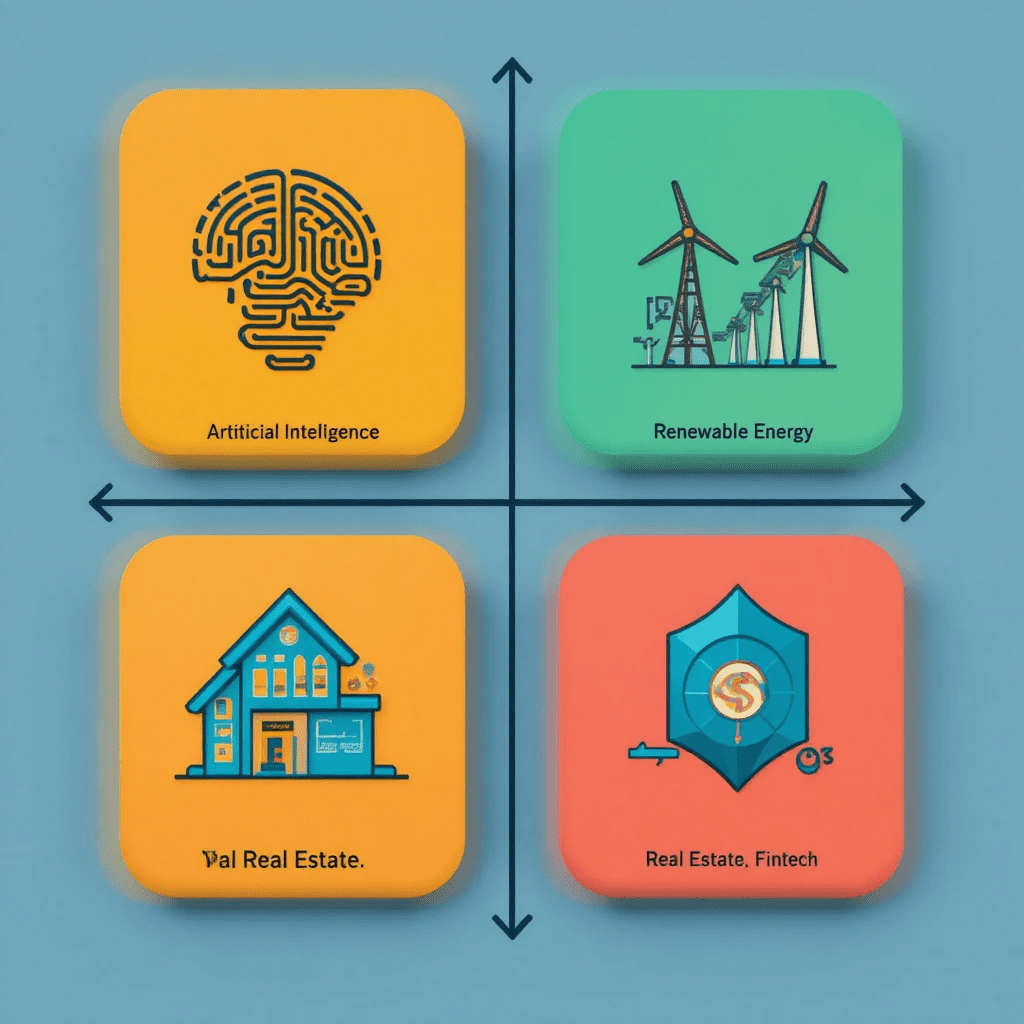

2. Top Investment Sectors to Watch

![Top Sectors]https://example.com/images/top-sectors-2025.jpg “investment guide 2025 – Top Sectors”

Artificial Intelligence & Automation

- AI ETFs, robotics companies, and cloud infrastructure.

- High-growth potential with long-term scalability.

Renewable Energy & ESG

- Solar, wind, battery tech, and ESG-compliant funds.

- Supported by government incentives and global climate goals.

Real Estate in Emerging Zones

- Suburban growth in Australia, Brazil’s coastal cities, and tech hubs in Canada.

- REITs and fractional ownership platforms.

Fintech & Digital Banking

- Neobanks, payment processors, and decentralized finance (DeFi).

- Disrupting traditional banking with lower fees and better UX.

Explore BlackRock’s 2025 Investment Directions

3. Country-Specific Opportunities

USA

- Private equity, infrastructure, and inflation-protected bonds.

- AI startups and green tech.

UK

- AI, biotech, and digital banking.

- Government-backed innovation funds.

Canada

- TFSAs, green bonds, and real estate in tech corridors.

- Safe haven for long-term investors.

Australia

- Mining tech, AgTech, and suburban real estate.

- Strong ESG adoption.

Europe

- Cross-border ETFs, AI, and sustainable infrastructure.

- EU-wide digital finance initiatives.

Brazil

- High-yield fixed income, agribusiness, and fintechs.

- Pix and open banking revolution.

Read Franklin Templeton’s Global Outlook

4. Smart Strategies for 2025

- Diversify Globally: Spread risk across regions and sectors.

- Invest in Innovation: Prioritize companies leading in AI, ESG, and digital finance.

- Use Tax-Advantaged Accounts: TFSAs, IRAs, and local equivalents.

- Stay Liquid: Maintain emergency funds and flexible assets.

- Monitor Macro Trends: Inflation, interest rates, and policy changes.

Check WTW’s Global Investment Outlook

5. Tools & Platforms to Use

- AI-Powered Portfolio Managers: Betterment, Wealthfront, or local equivalents.

- Fractional Investing Apps: Robinhood, Nubank, Stake.

- Global ETF Platforms: Vanguard, iShares, XP Investimentos.

- Crypto & DeFi: Coinbase, MetaMask.

6. Common Mistakes to Avoid

- Overconcentration in one asset class.

- Ignoring fees and tax implications.

- Following hype without research.

- Neglecting long-term planning.

Conclusion

This investment guide for 2025 is built to be more than just informative—it’s designed to be viral, useful, and profitable. By combining global insights, emerging trends, and actionable strategies, you can position yourself to thrive in 2025 and beyond.

Read::

Next Steps:

- Share this guide on social media.

- Subscribe to InvestSmartEdge for weekly insights.

- Watch our YouTube breakdown of this article.

- Download the free checklist: “Top 25 Investments for 2025”.

Ready to invest smarter? Let’s go, and Downlosd for free your eBook “10 smart ways you can build wealth in today’s economy”